PARTNERSHIP FORMATION (Quick Notes)

I. Partnership: Definition, Features, Types and, Theories

Partnership (Article 1767). By the contract of partnership, two or more persons bind themselves to contribute money, property, or industry to a common fund with the intention of dividing the profits among themselves.

Association of two or more Persons

Business Profit

Carry on as Co-owners

- Assignment of a partnership interest

- Ease of formation

- Limited life

- Mutual agency

- Separate legal entity

- Sharing profit and losses

- Unlimited liability

Types of Partnership

- General Partnership- are those in which each partner is personally liable to the partnership’s creditor if partnership assets are not sufficient to pay such creditors. At least one general partner in each partnership.

- Limited Partnership- partners who are limited in the obligation which they are based on their capital contribution.

Underlying Equity Theories

- Proprietary Theory- looks at the entity through the eyes of the owner.

- Entity Theory- views the business as a separate and distinct entity possessing its own existence apart from the individual’s partners

Articles of Partnership- agreement of partners before information

II. Accounting for Partnership Activities

1. Capital Account

|

| Capital Account |

|

| Drawing Account |

3. Loan Accounts

Ø These accounts are related-party transactions for which separate footnote disclosure is required, and it must be reported as a separate balance sheet item.

A partner’s capital interest is a claim against the net asset of the partnership as shown by the balance in the partner’s capital account, while, an interest in profit or loss determines how the partner’s capital will increase or decrease as a result of subsequent operations

Accounting for Partnership Formation

1. Cash investment- financial assets are recorded at fair value most often known as fair value as far as cash valuation is concerned.

---Foreign currency is valued at the current exchange rate.

---Cash in bank receivership should be shown its estimated recoverable amount

2. Noncash investment- recorded at an agreed value which is normally the fair value of the properties at the time of investment.

--If there is a conflict between fair and agreed value, the agreed value will prevail.

--In services, memo entry if there’s no value agreed upon, otherwise, journal entry.

--Liabilities assumed by the partnership should be valued at the present value (fair value) of the remaining cash flows.

GUIDELINES THAT ARE TO BE STRICTLY FOLLOWED REGARDING FORMATION:

REVALUATION/GOODWILL APPROACH

GOODWILL XX

CAPITAL XX

**********************************

TOTAL AGREED CAPITAL

LESS: TOTAL CONTRIBUTED CAPITAL

GOODWILL

|

BONUS APPROACH

A, CAPITAL XX

B, CAPITAL XX

ACCOUNT WILL BE DECREASED WHILE THE OTHER ACCOUNT WILL BE INCREASED SO THAT IT WILL BE EQUALIZE.

TOTAL AGREED CAPITAL

X CAPITAL INTEREST

PARTNER’S INDIVIDUAL CAPITAL INTEREST

LESS: B, CAPITAL INTEREST

BONUS TO B

|

| Individual vs. Individual |

|

| Individual vs. Sole Proprietor |

|

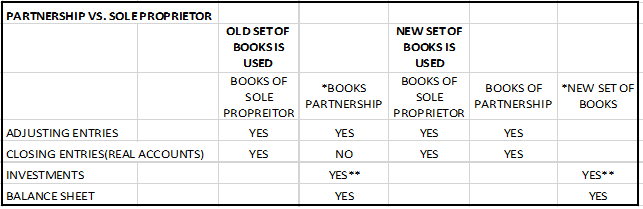

| Partnership vs. Sole Proprietor |

|

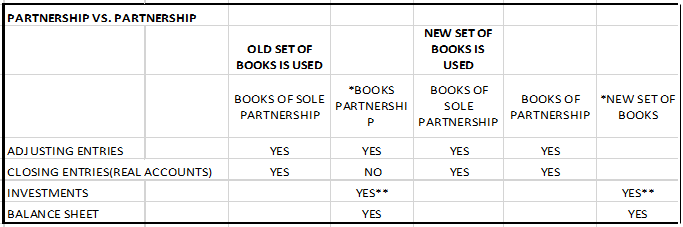

| Partnership vs. Partnership |

*PARTNERSHIP BOOKS

**ADDITIONAL INVESTMENT OR WITHDRAWAL

|

PARTNERSHIP OPERATIONS

(Quick Notes)

METHODS TO ALLOCATE NET INCOME OR LOSS

· In the absence of agreement, the share of each partner in the profits and losses shall be proportionate to what they have contributed based on capital contribution.

· Industrial partner shall receive such share as may just and equitable under the circumstance.

· Capital balance refers to whether original, beginning, ending, or average capital during the period. In the absence of agreement, it is presumed to be original capital, if not, beginning capital.

·

Proforma Entry:

Income summary xx

A, drawing xx

B, drawing xx

I. Arbitrary Ratio

This is based on the agreement of the parties. The parties can decide what ratio will be computed among the parties, even the loss can be decided by them.

II. Capital Balances

o Original capitalo Beginning capital

o Ending capital

o Average capital

--Guidelines:

a) What withdrawals or drawing accounts are to be recognized?

b) Only withdrawals above a certain limit are to be viewed as an offset against capital balances

c) Either personal withdrawals or temporary withdrawals or drawing accounts are not recognized in the computation of average capital.

1. Peso-day approach

2. Peso-month approach

III. Interest on Capital Balance

· Interest in the partner’s capital account is not an expense of the partnership.· The provision must be enforced regardless of whether operations are profitable or unprofitable.

· Interest allowed to the partners shall be added to the net loss and the total resulting loss shall be distributed in the agreed-upon by the partners.

IV. Salary Allowance

· Why is salary treated as an expense?

1. It is important to note that this treatment of partners’ salaries differs from the treatment of employee/shareholder's salaries of corporations.

2. Calculation of a partnership income after salary allowance is likewise proper in assessing the success of a business.

· Agreement provides for salaries without qualification, salary allowance must be made even though profit is inadequate to cover salaries or there is a loss.

V. Bonuses

· B= rate(Net Income-Salaries-Bonus-Interest)· The concept of a bonus is not applicable to a net loss.

CORRECTION OF PARTNERSHIP NET INCOME

· The correction is allocated to the individual partner’s capital account. The allocation should be based on the profit and loss agreement in effect during the period of the error.

SUBSEQUENT CHANGES IN METHODS TO ALLOCATE NET INCOME OR LOSS

· When the profit and loss sharing formula is revised, the new formula should contain a provision specifying that the old formula applies to certain types of subsequent adjustments arising out of activities that took place before the revision date.

THERE ARE ALSO SOME SPECIAL ALLOCATIONS OF NET INCOME BASED ON SOME CRITERIA, WHICH ALSO DEPEND UPON THE AGREEMENT OF THE PARTNERS.

.png)

0 Comments